ny paid family leave tax deduction

Key Takeaways For tax year 2021 the Child Tax Credit is up to 3600 or 3000 depending on the age of your child. Deductions for the period of time I was covered by this waiver and this period of time counts towards my eligibility for paid family leave.

Ny Paid Family Leave 5 Key Changes For 2019 The Standard

Payroll Deduction for NYs Paid Family Leave Starting July 1st.

. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service. Paid Family Leave provides eligible employees job-protected paid time off to. 2021 Paid Family Leave Payroll Deduction Calculator.

Use the calculator below to view an estimate of your deduction. The NYS Paid Family Leave Department has also released an on-line paid leave calculator to help with. Cost And Deductions Paid Family Leave.

The Department explains the steep increase in the 2021 payroll deduction rate is due to the PFL benefits increasing to 12 weeks of leave at 67 of pay the high utilization of the benefit and the rise in the cost of coverage. The maximum contribution is 19672 per employee per year. Katherine Muniz Jun 13 2017 New.

Each employees total remuneration is the amount prior to any deductions including deductions for the premiums for New Yorks Paid Family Leave program. In 2021 these deductions are capped at the annual maximum of 38534. The New York Department of Financial Services announced.

Therefore a maximum contribution of 741 per week per employee in 2021 regardless of age gender or. Say Thanks by clicking the thumb icon in a post. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions.

To update your rate or add your account. Ny paid family leave tax 2021 Friday March 4 2022 Edit. CITY STATE and.

Increased monetary pay out a shorter waiting period duration to collect benefits or a longer duration for benefits to be paid. The contribution remains at just over half of one percent of an employees gross wages each pay period. Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld.

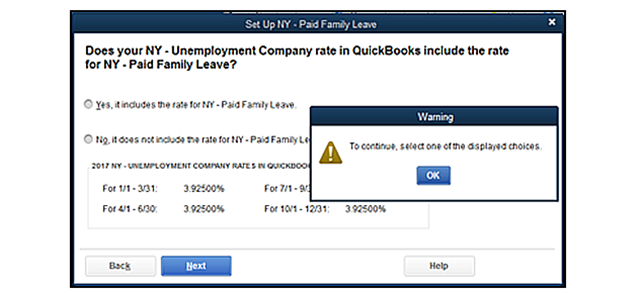

Paid Family Leave PFL Employee Fact Sheet PSB 440-16 Paid Family Leave for Represented Employees The deduction rate for 2022 is 0511 of an employees gross wages each pay period with a maximum annual contribution of 42371. The maximum total contribution for 2022 is to be 42371 for each employee 38534 in 2021. In the Taxes screen that pops up select the Other tab.

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. Double-click the employees name to open the Edit Employee window. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period.

BOND with a newly born adopted or fostered child CARE for a family member with a serious health condition ASSIST loved ones when a family. These benefits must be secured through a carrier licensed to write New York State statutory disability. An employer may choose to provide enhanced benefits such as.

New York State Paid Family Leave provides job-protected paid time off to employees who need time away from work to. The maximum annual contribution for 2022 is 42371. Go to Employees and select Employee Center.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current average weekly wage of 145017.

Select the Payroll Info tab and select Taxes. Employers may collect the cost of Paid Family Leave through payroll deductions. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages.

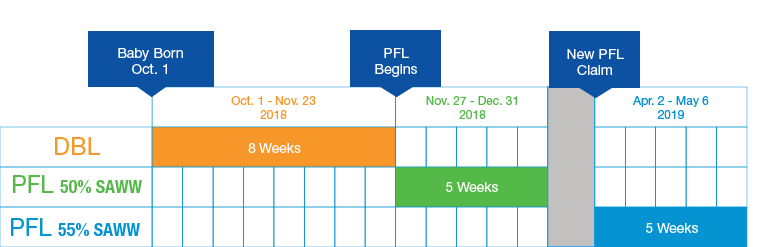

For 2022 the weekly taxable wage base for the family-leave insurance tax is to be the lesser of the employees gross wages for the week or 145017. Starting January 1 2018 the employee-funded program will provide New Yorkers with 8 weeks. Paid Family Leave PFL is now available to eligible employees of the City of New York.

Verify the New York Paid Family Leave item are there. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation.

Paid Family Leave may also be available. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current average weekly wage of 145017. Are benefits paid to an employee under the Paid Family Leave program considered remuneration that must be reported.

EMPLOYERS LEGAL NAME INCLUDING DBAAKATA 2. New York Paid Family Leave is fully funded by employee payroll contributions. The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a maximum annual contribution of 38534.

In 2022 these deductions are capped at the annual maximum of 42371. New York made headlines last year when it announced the passage of the nations strongest family leave plan known as the New York State Paid Family Leave Program. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

Employees earning less than the current Statewide Average Weekly Wage SAWW of. Youll find answers to your top taxation questions below. Refund of or credit for prior year state and local income taxes you actually received in 2021.

Based on the 2021 average weekly wage amount the maximum employee premium deduction for Paid. The New York State Department of Financial Services has announced that the 2021 premium rate and the maximum weekly employee contribution for coverage will be 0511 000511 of an employees weekly wage up to the statewide average weekly wage. Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax Reference link.

This amount is subject to contributions up to the annual wage base. New York Paid Family Leave Insurance rate. This amount is be deducted from employees post-tax income and is appear on their paystubs as a post-tax deduction.

Cost And Deductions Paid Family Leave New York State Paid Family Leave Cornell University Division Of Human Resources Paid Family Leave Ny Pfl Adp How To Read Your Payslip Integrated Service Center. Enhanced Disability and Paid Family Leave Benefits. New York Paid Family Leave is insurance that is funded by employees through payroll deductions.

Use the calculator below to view an estimate of your deduction. Use the calculator below to view an estimate of your deduction. Select OK twice to close the window.

2022 Paid Family Leave Payroll Deduction Calculator. I certify to the best of my knowledge the foregoing statements are complete and true.

Cost And Deductions Paid Family Leave

Nys Paid Sick Leave Vs Nys Paid Family Leave

Update New York State S Paid Family Leave Program

Cost And Deductions Paid Family Leave

Paid Family Leave Expands In New York The Cpa Journal

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

2022 Ny Paid Family Leave Rates Payroll Deduction Calculator Released

New York Paid Family Leave Resource Guide

What If I Need To Set Up Paid Family Leave Insurance Payroll Deduction Insightfulaccountant Com

Tax On Dependent Care Paid Family Leave For Ny N

New York State Paid Family Leave Cornell University Division Of Human Resources

What If I Need To Set Up Paid Family Leave Insurance Payroll Deduction Insightfulaccountant Com